PEPE Price Prediction: Navigating Short-Term Pressure Against Long-Term Potential

#PEPE

- Technical indicators show short-term bearish pressure with price below 20-day MA and negative MACD divergence

- Fundamental developments including mine-to-earn model and specialized exchange provide long-term utility value

- Critical support at $0.00000908 with resistance at $0.00001030 defining near-term price action parameters

PEPE Price Prediction

Technical Analysis: PEPE Faces Key Support Test

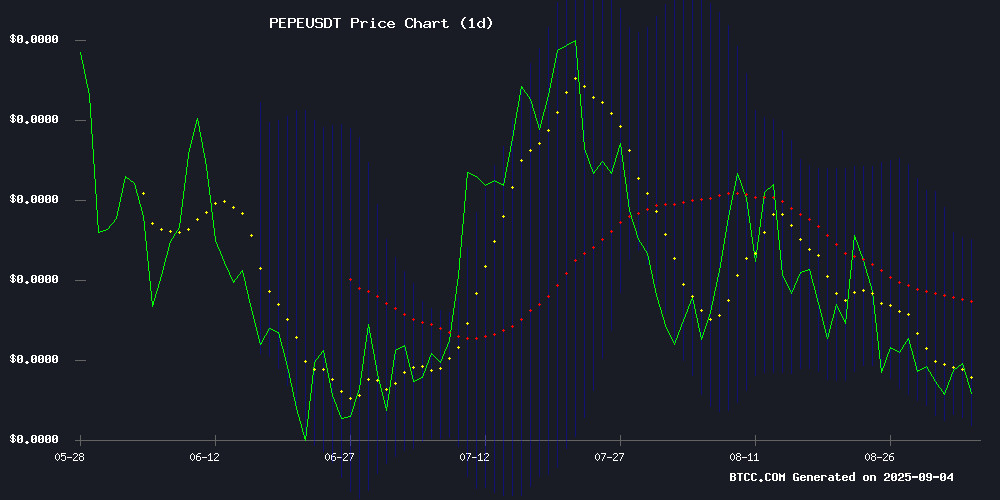

PEPE is currently trading at $0.00000960, below its 20-day moving average of $0.00001030, indicating short-term bearish pressure. The MACD shows a slight negative divergence with the signal line at 0.00000055 versus the MACD line at 0.00000052, suggesting weakening momentum. However, the price remains above the Bollinger Band lower limit of $0.00000908, which could serve as critical support. BTCC financial analyst John notes: 'The current technical setup suggests Pepe is testing crucial support levels. A break below $0.00000908 could trigger further downside toward $0.00000850, while holding above may lead to consolidation before any potential rebound.'

Market Sentiment: Mixed Signals Amid Development Activity

Recent news flow presents a contrasting picture for PEPE. Negative headlines highlight a 15% downside risk due to declining market activity, potentially weighing on short-term sentiment. However, positive developments include Pepenode's innovative mine-to-earn model generating 1000x gains speculation and PEPE Dollar's specialized exchange for memecoin trading, which could enhance ecosystem utility. BTCC financial analyst John comments: 'While near-term headwinds exist from reduced market activity, the project's fundamental developments around utility and exchange infrastructure provide longer-term bullish catalysts that may outweigh current technical weakness.'

Factors Influencing PEPE's Price

PEPE Cryptocurrency Faces 15% Downside Risk Amid Declining Market Activity

Meme-inspired cryptocurrency PEPE is under significant selling pressure after breaking below a critical support level, with analysts warning of a potential 15% decline. Trading volumes have plummeted to $980 million, while open interest contracted 4% to $535 million—a clear signal of dwindling trader confidence.

Derivatives markets reveal a stark imbalance: long positions suffered $326,000 in liquidations compared to just $9,900 in shorts. On-chain metrics paint an equally bleak picture, with daily active addresses collapsing to fewer than 3,000—a far cry from the 27,500-address peak during late 2024's rally.

Technical analysts note PEPE's breakdown from a symmetrical triangle pattern, with Alpha Crypto Signal projecting a downward trajectory toward $0.0000080-$0.0000085. Exchange data shows concerning accumulation trends, as the top 100 wallets increased holdings by merely 0.2% while exchange reserves grew 1.13%.

The token's recent 5% price swing between $0.000009567 and $0.000010028 underscores mounting volatility. Despite briefly testing the $0.000010 level earlier this week with 2.6 trillion tokens changing hands, PEPE now faces strong headwinds as market participation evaporates.

Pepenode's Mine-to-Earn Model Sparks 1000x Gains Speculation

A new frog-themed meme coin, Pepenode (PEPENODE), is generating presale buzz with its innovative mine-to-earn utility model. Unlike the wave of short-lived Pepe derivatives in 2023, this project introduces gameplay mechanics where token holders can purchase virtual miner nodes that generate continuous rewards.

The project's tokenomics feature a 70% burn mechanism on upgrade transactions, creating deflationary pressure. One prominent trader has projected potential 1000x returns by 2025, drawing comparisons to PEPE's historic rally. The mine-to-earn system requires no technical expertise, designed with mobile game-like accessibility.

Pepe Dollar Develops Specialized Exchange for Memecoin Trading and Creation

Pepe Dollar (PEPD) is taking an unconventional approach in the meme coin space by building infrastructure rather than relying solely on hype. While competitors like Pepe Unchained (PEPU) focus on Layer-2 scaling, PEPD is constructing an exchange tailored for day traders and meme coin creators.

The platform addresses key pain points with liquidity pools tied to PEPD, frictionless swaps for rapid position changes, and transparency tools for wallet flow analysis. This structure transforms meme coin trading from pure speculation into a more measured activity resembling traditional crypto markets.

Beyond trading, the exchange doubles as a token factory through its Pepedollar.fun minting engine. This dual functionality positions PEPD not just as another meme token, but as potential infrastructure for the broader meme economy.

Is PEPE a good investment?

PEPE presents a mixed investment case currently. The token faces technical headwinds trading below its 20-day average with bearish MACD signals, suggesting potential near-term pressure toward the $0.00000908 support level. However, fundamental developments including Pepenode's mine-to-earn model and Pepe Dollar's specialized exchange infrastructure provide longer-term utility value.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $0.00000960 | Below MA |

| 20-Day MA | $0.00001030 | Resistance |

| Bollinger Lower | $0.00000908 | Key Support |

| MACD Signal | -0.00000002 | Bearish |

BTCC financial analyst John suggests: 'Investors should consider PEPE as a high-risk, high-reward proposition. Short-term traders might wait for a clear break above $0.00001030 for bullish confirmation, while long-term holders could accumulate near support levels given the project's ongoing development activity.'